Something big just happened. And Wall Street’s cheering.

Global equity markets surged as the US and China reached a surprise trade deal. This trade deal lifted tariffs, eased tensions, and sent risk assets flying. The S&P 500 jumped nearly 4% last week. Nasdaq? Up even more. Asian markets popped. European indices followed suit.

It was the kind of rally that made the bears rethink everything.

So, what’s behind this sudden shift? Is this the start of the long-awaited V-shape recovery? Or just another temporary volatility in a choppy macro environment?

US-China Trade Deal Triggered The V-Shape Pattern

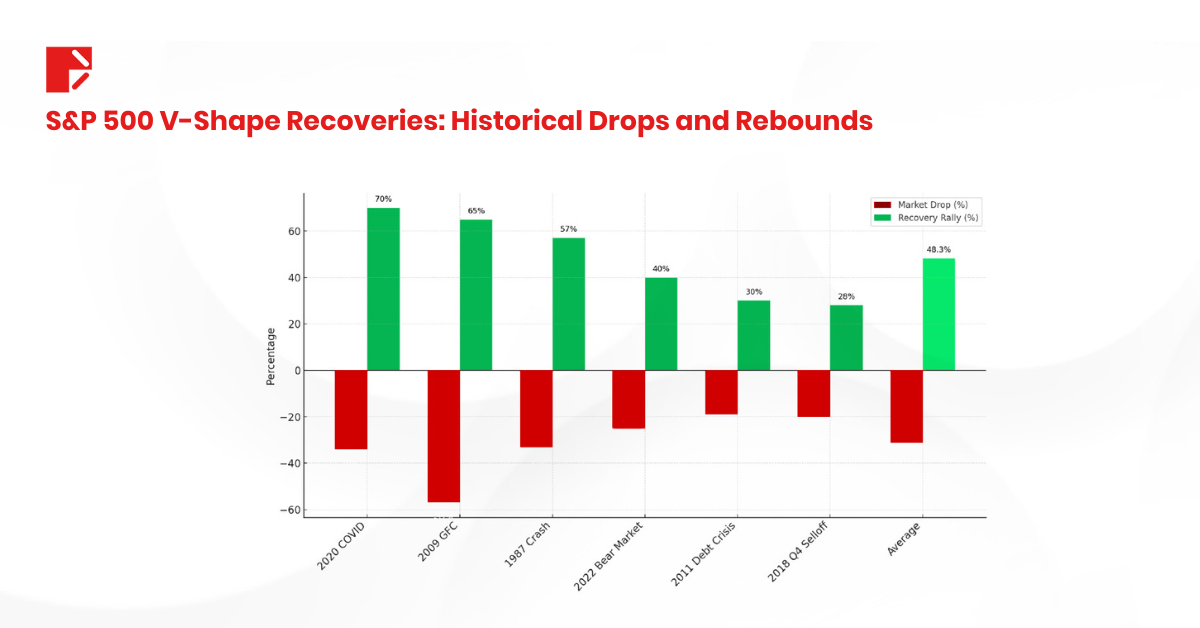

A V-shape recovery is the holy grail of market rebounds. It’s fast, sharp, and clean: crash, then boom. Think COVID-19 in 2020, Brexit aftermath and 1987. When fear peaks and markets snap back with power.

And this current surge? It’s starting to echo that familiar pattern.

Historically, the S&P 500 has delivered some incredible V-shaped comebacks. During the 2020 COVID crash, the index plunged over 30%, only to rocket back 70% in record time. In 2009 after the global financial crisis, a similar snapback saw a 65% rally. Even the brutal 1987 crash was followed by a 57% surge.

On average, these V-shape rebounds produce a 48.3% rally after sharp market drops—according to the chart from historical S&P recoveries.

Now with this US-China deal, the market may have just found its next catalyst. We’ve had the drop. This week’s rally might be the beginning of the “lift.”

Trump’s “Art of the Trade Deal” Moment

Call it what you want; chess, 5D strategy, or political theatrics, but Trump’s negotiation style just delivered a tangible win.

After a prolonged tit-for-tat tariff, tense rhetoric, and global uncertainty, the two economic superpowers agreed on a framework that removes several trade barriers and opens doors for technology, manufacturing, and agriculture.

Despite critics calling his tactics reckless, Trump’s latest move echoes what he once claimed in his book: “Deals are won before they’re signed.”

He applied pressure, held firm, and now both nations walk away with concessions that benefit their domestic economies. It’s hard not to see this as a textbook “Art of the Deal” play unfolding in real-time.

What It Means for Traders Right Now

For investors and traders, this isn’t just good news, it’s fuel. Here’s why:

- Reduced Global Uncertainty: Less tension between the US and China lowers tail risk across markets. That means higher investor confidence and more risk-on positioning.

- Strength in Cyclicals: Materials, industrials, and energy stocks are rallying on hopes of revived trade volumes.

- Breakout Levels Getting Tested: The S&P 500 blasted through the 200-day moving average. If it holds above this zone, the next leg could push toward all-time highs.

Sector Rotation: Watch This Closely

While tech continues to dominate headlines, don’t sleep on sectors that were lagging during the trade war era. Semiconductors (heavily exposed to China), heavy machinery stocks, and multinational consumer goods companies are all seeing fresh capital inflows.

This trade deal flips the script for global growth-sensitive names. If follow-through continues, these areas could outperform in the next cycle.

Sentiment Shift Confirmed

The Fear & Greed Index, going from “Extreme Fear” to “Greed” in just a few weeks. Option flows are leaning bullish again. Even fund managers, previously defensive, are now rotating back into equities.

This isn’t just price action, it’s a sentiment pivot. A psychological turning point that tells us traders aren’t just reacting, they’re potentially positioning.

But Let’s Not Get Ahead of Ourselves

Yes, the rally is strong. Yes, the news is good. But the market’s not a straight line.

Some caution flags to keep in mind:

- Earnings Season Ahead: Q2 results will reveal how companies are navigating inflation and growth.

- Inflation Isn’t Gone: While easing trade tensions helps, prices remain sticky in key sectors like housing and services.

- China’s Economy Still Fragile: This deal might stabilize sentiment, but China’s recovery post-COVID has been inconsistent.

So, stay sharp. Bullish doesn’t mean blind.

History Loves a Good Trade Deal

Historically, breakthroughs in US-China trade relations have sparked strong market runs. The 2019 Phase One deal kicked off a multi-month rally. The 2001 WTO accession helped launch a global commodity boom.

If this current deal leads to sustained cooperation, we could be looking at another multi-month bull cycle taking root.

And traders who recognize that early? They get to ride the V all the way up.

Key Takeaways

This wasn’t just a bounce. It was a momentum shift.

Markets love clarity, and this trade deal brings just that. Combined with improving sentiment, a cleaner technical picture, and stronger cross-sector participation, bulls finally have their shot.

And it couldn’t have come at a better time.

So, whether you long equities, trading short-term breakouts, or simply looking for macro confirmation, the message is clear: this deal matters.

Stay focused. Stay ready.

The next leg of the rally might just be getting started.

Start your trading journey today by clicking here.

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.